This is the first article in a series of posts about Debtor Radar, a new debtor analysis and cash flow advisory tool for accountants from Debtor Daddy. If you’re an accountant you’ll be able to learn more here. Our goal with Debtor Radar is simple: Help more small businesses solve the cash flow troubles caused by debtors.

To do that we’re enlisting the help of thousands of accountants worldwide who share our passion for improving cash flow and making small businesses more successful.

Why?

Because debtors are one of those problems that too many businesses choose to avoid. Check out these stats from some recent research by Debtor Daddy summarising the debtors situation for over 500 small businesses debtors:

- 70% had more than 50% of invoices overdue

- 33% had more than 50% aged +60 days

- 41% had more than $50k overdue

- Average debtor days: 33 days

- The trouble is that in a small business, the business owner or office manager is head-down working on the day-to-day. Debtors often get put the the bottom of the pile, it’s too hard, it’s too time consuming, and owners lack the skills and tools to get it done right.

This is where you come in.

Step 1: Highlight the problem (or opportunity)

Our first step is to arm you the accountant with the information you need to spell out the extent of the problem in black and red. Plus you’ll also be able to hold your client accountable by monitoring the debtors situation over time.

How is this possible without logging in to each client’s accounting software every month to run reports?

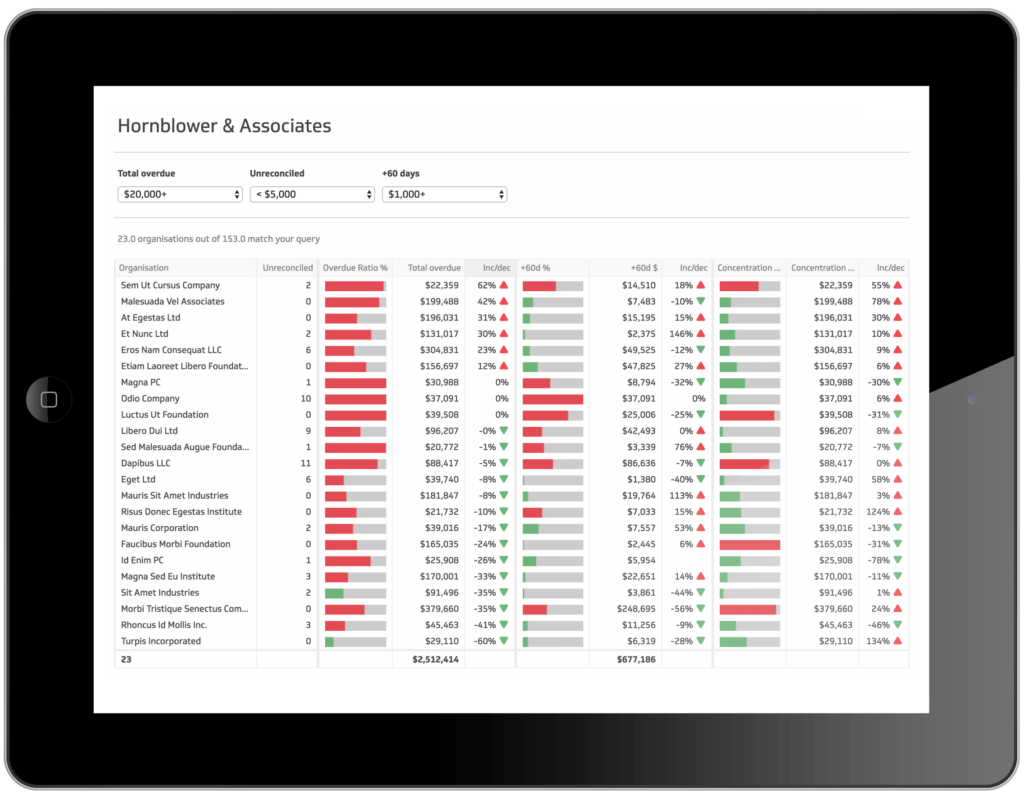

The answer is Debtor Radar, our new debtor reporting tool that monitors all your clients’ debtors situations, sending you (or your client managers) a detailed monthly report of who’s at risk. Straight to your inbox, no work required.

Step 2: Delight your client

Armed with these key stats around debtors, it’s as simple as picking up the phone or firing off a quick email to your client:

“Hey Samantha, I noticed your debtors have crept up since last month and I can see you’ve got more than 40% ($134k) that’s more than 60 days overdue. Just checking if everything is under control or would you like some help?”

Now if you’re Samantha, head down, working in the business, it’s super nice to know your accountant has got your back. Especially if it’s been a few months of not hearing from him.

Debtor Radar becomes your perfect excuse for staying in touch and positioning yourself as first point of contact when it comes to the health of their business.

Step 3: Refer them to a specialist

As an accountant you’re the GP for your client’s financial health but from time to time it pays to engage a specialist for the more challenging complaints. Debtors are a perfect example, as they usually require a concerted effort to get them under control… starting with the hardest part – changing the behaviour of your client!

At Debtor Daddy we speak to dozens of businesses every week, helping them systemise and automate away the pain of managing debtors, so their cash collection runs like clockwork – every month.

Don’t be fooled into thinking that solving late payment problems is as simple as turning on email reminders. That’s table stakes and our data shows that only solves part of the problem. If you really want to solve debtors for good then a more holistic approach is required, involving education plus dedicated debtor management tools that make the whole job from reminders to phone calls to letters easy (and maybe even fun).

If you’re an accountant that wants to help us tackle the age-old problem of aged receivables and improve the health and cash flow of small business everywhere then register for a Debtor Radar demonstration today.

Be part of the solution for stronger, healthier businesses.